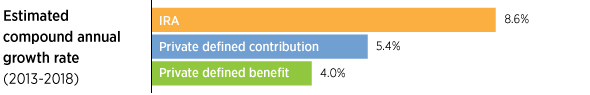

With their growth rate expected to nearly double that of 401(k) assets in the next five years, individual retirement accounts (IRAs) continue to be a leading segment in the retirement industry.

Here are some highlights of the growing IRA market:

1. The traditional IRA represents the largest share of U.S. retirement assets.

In a 2014 projection by Cerulli Associates, IRA assets of $6.4 trillion make up nearly one third — 32% — of the retirement market. Private defined contribution assets totaling $4.4 trillion and private defined benefit with assets totaling $2.9 trillion represent 22% and 14% of the market, respectively.

2. Rollovers are driving asset growth.

About 7 out of 10 traditional IRAs opened in 2012 were funded by rollovers, according to the Investment Company Institute (ICI).

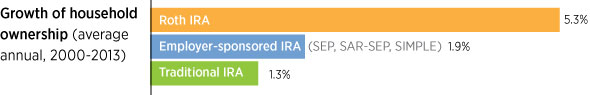

3. Roth IRAs are the fastest growing IRA type.

Source: Investment Company Institute, 2013.

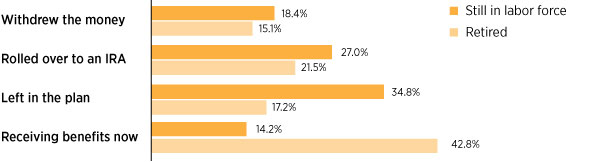

4. Employment status has a lot to do with the decision to roll over assets from a 401(k) plan.

According to a recent study from the Employee Benefit Research Institute, most people over the age of 50 who changed jobs left the money in the retirement plan. The second leading choice was an IRA rollover. Account balances and income level also influenced the decision. The study also found that retirement savers who already own an IRA are more likely to roll over their 401(k) balance to an IRA.

What 401(k) savers are doing with their assets

Source: Employee Benefit Research Institute estimates from Health and Retirement Study, 2014.

Growing market

Recent studies show that there are increasing opportunities for financial advisors to work with clients considering an IRA rollover. Understanding how account balances and incomes weigh on the rollover decision may help advisors discuss options with clients and explore how these assets may fit into their overall financial plan.

288859

More in: Retirement/Income